Capgemini - Payments innovation: the past holds the key to the future

Capgemini Global Financial Services' chief sales and marketing officer, Jean Lassignardie, and Simon Newstead, managing director of market engagement for the payments business at RBS, provide insights into developing and mature payments markets, e and m-payments, new regulatory initiatives and payments-processing innovation.

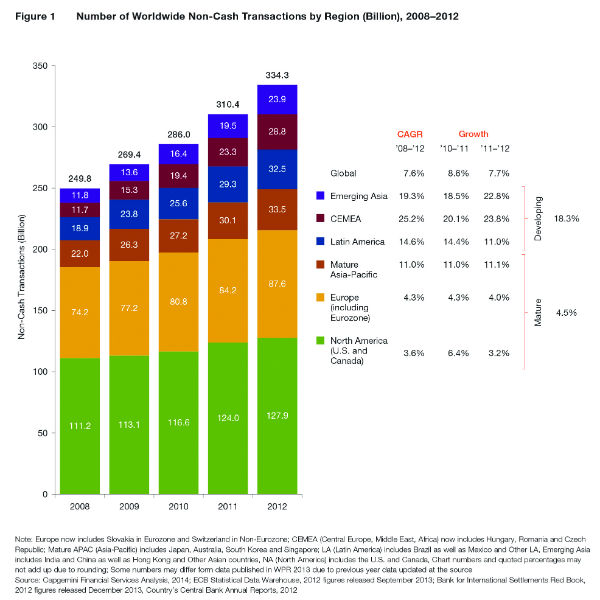

During the past decade, the global non-cash payments market has doubled to reach 366 billion transactions. More recently, developing markets and a greater use of credit and debit cards are fuelling this remarkable growth story, according to the Capgemini and RBS tenth annual World Payments Report (WPR), which was recently published.

The WPR has analysed non-cash payments volumes globally, as well as key market trends for the past decade. The latest report explains that global non-cash payments volumes are expected to have grown 9.4% between 2012 and 2013. Looking ahead, rapid growth is likely to continue, with developing and mature markets expected to increase their payment volumes further.

Developing markets are driving non-cash payment growth globally, recording an impressive 18.3% increase compared with 4.5% across more mature markets in 2012. These significant growth levels, which are predicted to be sustained, represent a huge opportunity for the payments industry.

The analysis reveals that more than 50.0% of global non-cash payment growth came from developing countries, despite these countries only accounting for 25.5% of the market size, with China emerging as the country to watch. Indeed, if growth rates remain at their current levels, China could become the largest market for non-cash transactions within five years.

It remains a relatively underdeveloped market for non-cash transactions, but its population and growth rate suggest that it could outstrip the US and eurozone. Already, one in five people in the world who use mobile banking live in China, according to recent research by CGAP.

The global growth chart presents a mixed picture; the rocketing growth in the developing markets has been balanced by a deceleration in mature markets such as North America and Europe. The US experienced a slowdown in non-cash transaction growth from 6.5% in 2011 to 3.4% in 2012, reaching 118 billion transactions, which represents approximately 35.3% of the global total of the non-cash payments industry.

The WPR attributes the US slowdown primarily to decreased debit-card transaction levels (5.5%). Additionally, the larger US banks have placed more emphasis on non-cash instruments since new debit-card regulations capped interchange fees.

As a result of all of these changes, global transaction growth fell from 8.6% to 7.7%, to 334 billion transactions during 2011-12. However, the WPR analysis suggests that this deceleration is only temporary. Developing markets are expected to record 20.2% growth from 2012-13 and mature markets, including the US, are expected to reach 5.6% growth.

Consumer demand and changing payments

As the non-cash growth pattern continues, payment services providers (PSPs) are under increasing pressure to innovate and develop new services to satisfy retail and corporate customers.

Mobile payments (m-payments) have continued to grow exponentially - according to the WPR, m-payment transactions are expected to grow by 60.8% annually through to 2015. E-payment volumes also continue to grow, but at a reduced rate of 15.9%. This is a reflection of the increasing convergence of e and m-payments.

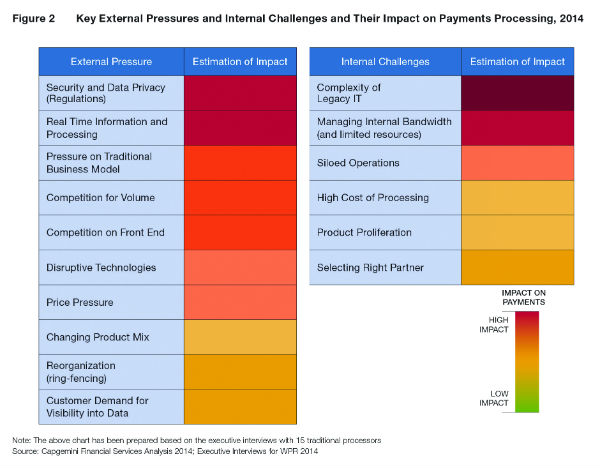

The increased use of tablets and smartphones has contributed to growth in mobile payments, but this has also proven to be challenging for some traditional PSPs. Providers need to actively consider the need to modernise their payments-processing infrastructures to support fast-evolving customer-facing channels and options on the marketplace. Immense pressure is coming from competition and new regulatory initiatives to provide next-generation innovations for tangible customer value.

Against this background, WPR primary research has found that the majority of traditional payments providers are now making the transformation of payments processing a near-term priority, but delivering such fundamental changes successfully will require a long-term vision.

Developing such a vision requires a clear understanding of changing consumer behaviour and the likely impacts of the evolving regulatory environment. The WPR highlights 34 current regulatory/industry initiatives with significant implications for the payments market, including the Basel III requirements for capital and liquidity; anti-money laundering and antiterrorist financing laws; the trend to real-time retail payments; data privacy; virtual currencies; and financial inclusion initiatives, all of which providers and clients need to have on their radars.

The increasing complexity, scope and interplay between these initiatives require a more holistic approach than ever before. An executive at one central bank in Europe noted that it is changing its systems and processes to meet regulatory requirements on a case-by-case basis. This approach takes time and resources to effectively manage compliance.

Updating legacy systems and facing challenges

There has been significant progress in innovation on the customer-facing part of the payments industry; the WPR finds that it is also important that the payments back office keeps pace. The time has come for many PSPs to transform their internal payments-processing infrastructures to better support front-end innovations.

Many payments firms have already taken strides towards such a transformation, but the WPR suggests that these firms will need to be vigilant in their end-to-end project management to overcome execution challenges, and not to deviate from their core plan and vision.

While adoption of an incremental, agile approach to a large multiyear project is common sense, not all firms have adopted this approach to date. Examining short and medium-term business and payment objectives, as well as assessing the overall desired end-state will help firms understand gaps/bottlenecks while also helping to build an attainable transformation vision. During execution, firms should integrate 'short-cycle projects' along with robust programme management to deliver business benefits 'along the way' to mitigate project risks while addressing business-case/benefits-case requirements.

In parallel with managing their internal transformation process, PSPs will also need to continue to participate in changes and initiatives in the external collaborative space. Engaging in new market projects in areas such as real-time low-value payments and security enhancements and standardisation has the potential to help PSPs better meet their customers' evolving requirements, while improving shared processing capabilities.