Capgemini Global Financial Services: social banking - Jean Lassignardie

Capgemini Global Financial Services' chief sales and marketing officer Jean Lassignardie analyses the company's Voice of the Customer survey, and looks at what's next in digital transformation.

Over the years, banks have become experts at adding new distribution channels; greatly expanding the convenience they offer customers. They are now adept at offering services not just through branches, but also through ATMs, phones, websites and mobile devices.

This vast distribution network has come together slowly over decades, with banks adding new channels only once the technologies were mature and had significant followings. The result has been a piecemeal approach, with each channel often requiring its own set of supporting technology and staff.

The findings of Capgemini and Efma's 'World Retail Banking Report 2014' (WRBR) indicate that banks are now reaching an inflection point in which accommodating each new digital technology via a one-off, siloed channel is no longer acceptable. Digital interactions are becoming so pervasive and important that they require banks to adopt an entirely new mindset.

A strategy of digital transformation, involving the adoption of digital technologies along with highly evolved change management and leadership skills, is critical to ensuring digital becomes part of the lifeblood of the institution.

The WRBR also reveals bankers may be doing a good job of accommodating new digital channels, but are still falling short in terms of embracing full digital transformation. Specifically, it found customer expectations with respect to social media are going largely unmet.

Social media spills into banking

Though social media is still most popularly used for social networking, banking and social media are coming together to an increasing degree. Among the more than 17,000 retail-banking customers queried globally in the WRBR's Voice of the Customer survey, more than 89% said they have a social media account. Younger people in emerging markets are the most active users, with more than 50% of respondents in Latin America, the Middle East/Africa and Asia-Pacific under 35 years old spending at least an hour a day on social sites.

Bankers may be surprised at how large a role social media is already playing in banking. While it has not matured into a bona-fide channel for executing transactions, it is increasingly headed in that direction. Already, in different regions around the world, at least 10% of customers from the survey say they are using social media at least once a week to interact with their bank. The heaviest users of social media banking are in Asia-Pacific (16.0%) and Eastern Europe (13.0%), followed by North America (12.4%) and Western Europe (10.8%).

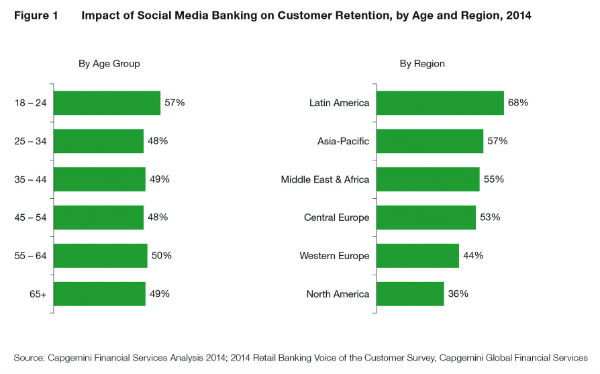

Offering positive banking experiences via social media has important implications for banks. The survey found retention is likely to increase at banks offering strong social media experiences, with around half of all customers saying they would be more likely to stay at banks that offered them, and the percentage edging higher for those 18- 24 years old (57.3%) and for those in Latin America (67.9%) (see Figure 1).

Referrals and cross-selling also are expected to get boosts from positive social media experiences. About a third of customers of all ages with positive encounters in social media banking (and 37% of 18-24 years) said they were likely to refer friends. In Latin America, 52% said they would refer friends. Further, about a quarter of customers of all ages (and 28% of those 18-24 years) said they would buy more products from a bank with strong social media capabilities. This was especially so in Latin America, where 45% said they would.

Despite the benefits of offering social media, banks are failing to make available to customers the type of social media functionality they would like. For example, customers ranked access to account information as the most important social media banking function, but only 0.1% of them currently receive it. Servicing capabilities also fell short, with customers giving it medium to high importance, but only 5.8% of them receiving it. Of all the functionalities, customers ranked social collaboration the lowest. Yet a relatively higher percentage of customers, 11.5%, have it provided to them.

Clearly, customers - especially younger ones - are ahead of banks in accepting social media. Institutions with a core competency in executing digital transformation will be best positioned to meet the needs of customers as social media expectations in banking continue to grow. In making their mark on social media, banks must act quickly. It is up to them to define how banking will work on social media, before social media ends up redefining banking.

Shaping social media

Though banks are pursuing a wide range of strategies in their attempts to take advantage of the reach and popularity of social media, no single model has yet emerged as the correct one to follow. Through ongoing experimentation and research, banks must continue to gain insights into customer preferences on social media. Already, non-banking players are aggressively leveraging the platform threatening to draw large numbers of customers away from established institutions.

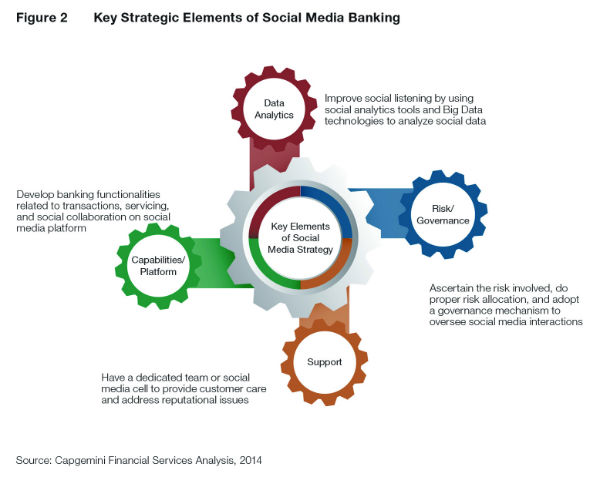

As banks shape their social media strategies, they will initially seek to simply establish a presence on the platform, perhaps creating a blog or actively monitoring and responding to customer feedback on social networking sites. Over time, social media will become increasingly connected to the other channels, ultimately acting seamlessly with them to ensure the entire product life cycle is carried out. This type of omnichannel functionality is a critical aspect of effective digital transformation. The future state of social media in banking is hard to predict, but will likely involve complex decisions and adaptive analytics aimed at making banks more proactive on social media (see Figure 2).

With technology advancing quickly, new options for social networking constantly becoming available, and consumers shifting loyalty to technology and the social sites they frequent, banks should maintain flexible IT and domain architectures for incorporating social media platforms. They should seek to own the infrastructure of social media banking so as not to lose control over the evolution of this channel.

Carrying out a successful social-media plan will require a multilayered infrastructure. Banks will need appropriate platforms to develop and host social media applications that are appealing to customers. They will have to store large amounts of social media data and process it using big data analytics to generate customer insights. Social media also requires support staff to provide live customer care, and handle any reputational issues arising on the channel.

All of these elements must be housed within a governance mechanism that clearly defines the objectives of the bank's social media strategy and imposes appropriate risk mitigation routines. Comprehensive training regarding appropriate employee behaviour on social media, as well as continuous oversight of employee communications, must be put in place. Finally, banks must be prepared to guarantee the safety and security of customer data at all times.

The continual addition of new channels is a hallmark of modern banking. Social media merely continues this evolution, which has shaped banking for the last half-century. By now, banks should be moving beyond one-off approaches to new channels, and have in place effective strategies for transforming with the times. Expertise in digital transformation will ensure banks retain deep connections with their customers, even as they embrace new technologies like social media.