CapGemini Financial Services: Office politics - keep up with customers

Andy Lees, global sales officer, Capgemini Financial Services, tells Future Banking exactly how customer experience can be improved through a focus on middle and back offices.

The ability of banks to build relationships with customers - one of the most important aspects of retail banking - is faltering, according to the findings of the most recent World Retail Banking Report 2015. Customers are increasingly displeased with the interactions they have with their banks and are exhibiting less loyal behaviour. On top of that, a host of new competitors are seeking to disengage customers from their primary banks.

To combat the threats and secure a position at the forefront of their customers' financial lives, banks must take steps to improve the customer experience, particularly in the often-overlooked middle and back offices.

A central impediment to better relationships with customers is the increasing inability of banks to connect with customers in ways that meet their expectations. Capgemini Financial Services' Voice of the Customer survey, which takes a multidimensional look at how well banks are meeting customer expectations, recorded a 0.2% drop in 2014, on top of a 0.6% drop the year before indicating stagnation.

As generation Y (or millennial) customers, who were born between 1980 and 2000, are showing lower levels of enthusiasm for their banks, this situation is not likely to improve. Across the world, generation Y customers have less-positive attitudes about their customer experiences with banks than customers in all other age groups. In North America, for example, the difference is 7.9%; in Western Europe, it is 5.7%.

Attitude adjustment

Changing customer attitudes towards banks appears to be showing new behaviours that are detrimental to relationship-building. Customers around the world say they are more likely to leave their bank in the next six months and less likely to refer others. Perhaps most foreboding is a double-digit increase throughout all geographic regions in the number of customers who said they would not buy another product from their primary bank. Western Europe was the most extreme, with more than a third of customers (35.3%) saying they would not purchase another product from their primary bank, up from only 9.6% a year earlier.

As bank-customer relationships are becoming increasingly destabilised, a growing set of non-bank competitors are making inroads into the retail-banking market. The biggest challenge comes from internet and technology companies that have demonstrated an ability to win over the hearts and minds of customers through development of a steady stream of useful, intuitive devices. Already, such firms have carved out a significant presence in the area of payments and credit cards.

With their hold on customer loyalty slipping, banks must take steps to improve the customer experience. Most importantly, they cannot shortchange the many middle and back-office processes that are critical to ensuring superior customer interactions. Historically, banks have invested mostly in front-end touch points, such as mobile applications and internet web sites, at the expense of processes that occur behind the scenes, but are no less important.

Banks simply do not tend to view middle and back-office processes as relevant to the customer experience. This perception problem became starkly evident when Capgemini Financial Services asked bankers why they invested the way they did. For the front office, 92.6% of bank executives cited customer experience as the main driver. However, customer experience figured minimally in middle and back-office investments, which were mostly aimed at simplifying processes, mitigating risks and reducing costs. Only 53.8% of bank executives cited customer experience as a primary driver in middle-office investments, and 46.3% in back-office ones.

Middle and back offices need attention

In downplaying the role of customer experience in back and middle-office investments, banks have ended up with much lower levels of digital maturity in those areas, compared with the front office. Ad-hoc improvements in back and middle offices, made without an eye on enhancing the overall customer experience, have resulted in nearly 85.0% of those areas having only basic to mediocre digital capabilities, according to bank executives. Compared with the front office, where 31.5% have advanced levels of digital maturity, only 13.2% of middle offices and 14.8% of back offices do.

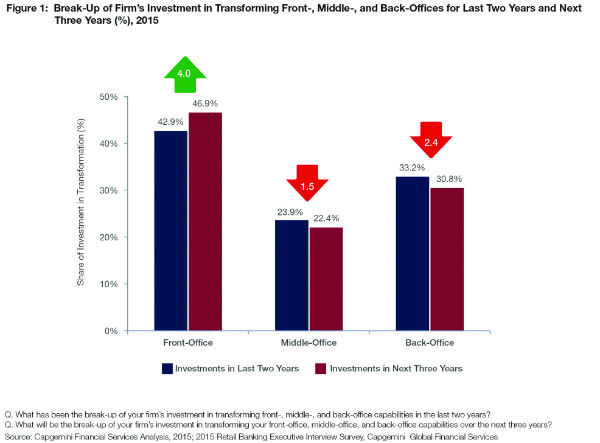

Future trends do not look promising. Bank executives predicted they would spend less over time on areas outside the front office. Over the next three years, investments in the middle office are expected to decrease by 1.5% to 22.4% of the total investment in transformation, and those in the back office by 2.4% to 30.8% (see chart, opposite). Meanwhile, investments in the front office, already high at 42.9% are expected to rise another 4.0% to 46.9%.

Banks' lack of attention to the customer experience in back and middle offices carries great risk. The fact that customers rarely, if ever, have contact with the back office should not obscure the reality that many of the service issues they encounter are attributable to problems that originate there. Slow processing times, errors and exceptions are among the back-office issues that contribute greatly to reduced service in the front office and, in turn, a poor overall experience for the customer. In fact, the majority (60%) of customer dissatisfaction emanates from back-office issues.

Operational errors that occur in the middle and back office can also inflict reputational damage, further weakening the overall customer experience. Negative publicity generated by banks that have erred in reporting, accounting or applying interest rates greatly detracts from feelings of trust and loyalty customers have for their banks.

The way forward

Improving the customer experience will require banks to bring all of their operational areas to full digital maturity. With the front office already well on its way thanks to ongoing investments in web and mobile interfaces, banks must now pay particular attention to the middle and back offices. The way forward is not expected to be easy. Bankers that Capgemini Financial Services surveyed delineated numerous challenges to digitally transforming the front, middle and back offices, with concerns about cost at the top and organisational drive coming in second. Other impediments cited were the ongoing presence of inflexible legacy systems and the difficulty of building a business case for long-term goals such as digital transformation.

To overcome these challenges, banks need to develop a well-structured roadmap that delivers a lower cost to serve via digital self-services channels and cost reduction through simplification, rationalisation and standardisation from a process, application and infrastructural point of view. Through standardising the interaction models customer information will become more accessible and usable. This will allow greater insight to be developed and, in turn, provide revenue enhancement opportunities along with improved retention.

In any project involving the transformation of middle and back offices, banks should set their sights on three main goals - replacing manual processes with digitised routines, simplifying multiple systems into fewer systems, and putting in place the ability to capture and manage customer data. Progress in any one of these areas is likely to have considerable impact on the other two. With a thoughtful approach to digital transformation, banks can improve their customer experience scores and position themselves in this evolving market to compete against nimbler, non-traditional entrants.