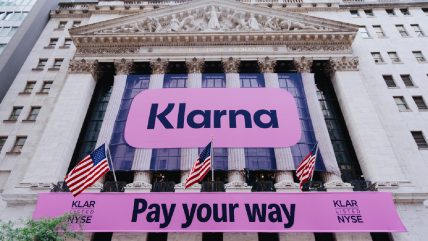

Swedish fintech company Klarna Group has raised $1.37bn through its initial public offering (IPO) on the New York Stock Exchange (NYSE).

The, company, which is engaged in providing buy-now, pay-later (BNPL) services, priced 34,311,274 ordinary shares at $40 each. Of these, Klarna sold five million shares, while existing shareholders sold the remaining 29.3 million shares.

The shares will begin trading under the symbol “KLAR” on 10 September 2025. An additional option has been granted to underwriters by the selling shareholders, allowing them to purchase up to 5.1 million more shares within a 30-day period to cover over-allotments.

Klarna said that it will not collect any proceeds from the shares sold by existing stakeholders.

The offering is expected to close on 11 September 2025, contingent upon standard closing conditions.

Key financial entities managing the IPO include Goldman Sachs & Co., J.P. Morgan, and Morgan Stanley as joint book-running managers. BofA Securities and Citigroup are among those serving as bookrunners, with additional firms acting as co-managers.

Last month, Klarna initiated a warehouse financing facility backed by German receivables and supported solely by Santander. This facility provides up to €1.4bn in funding capacity and forms part of Klarna’s broader strategy to diversify its funding sources for sustained growth.

Additionally, Klarna expanded its US financial strategy through a forward flow agreement with Nelnet, a US-based financial services firm. This multi-year agreement supports the expansion of Klarna’s Pay in 4 BNPL product across the US by facilitating the sale of newly originated short-term, interest-free receivables to Nelnet.

It is expected that up to $26bn in total payment volumes will be sold over the life of the programme.

Financial results for Q2 2025, which were reported last month, showed continued operational profitability for Klarna. The company recorded revenues of $823m and reached certain milestones including a customer base of 111 million active users and partnerships with 790,000 merchants worldwide.

Additionally, Klarna reported $1m in revenue per employee, a significant increase from $369,000 two years prior.